Of the Following Which Best Describes an Annuity

OA lump sum is deposited into an account earning simple interest. A lump sum is deposited into an account earning compound interest.

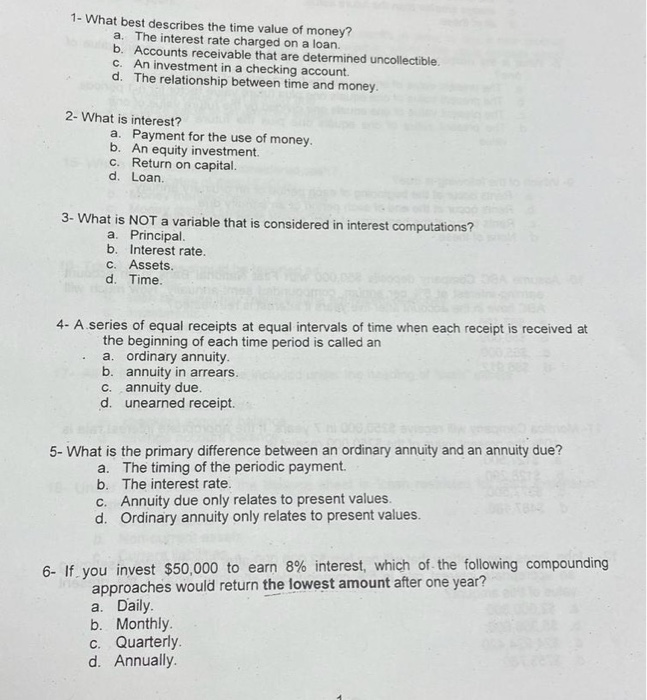

Solved 1 What Best Describes The Time Value Of Money A Chegg Com

B a series of unequal cash payments made at equal time intervals.

. An annuity is a series of equal payments and hence decreasing or increasing payments are not an. See what the community says and unlock a badge. Equal cash flows at equal time intervals for a specific time period.

Which of the following best describes the temperature coefficient of resistance of a certain material. In contrast an annuity due features payments occurring at the. Equal cash flows at equal time intervals for a specific time period.

Goal of imposing a crushing defeat of Russian aggression is secondary to our far more vital interest in avoiding a US-Russia war. A series of payments to be received during a period of time. Equal regular deposits are made into an account earning interest.

Also know what is an annuity due. It is the formula for the present value of a growing annuity b. Period of time from the accumulation period to the annuitization period C.

A series equal payments to be received at a common interval during a period of time. It is the formula for the present value of a growing annuity c. Accounting questions and answers.

Which one of the following statements best describes an ordinary annuity. Lumpy cash flows at equal time intervals for a specific time period. An annuity due is a repeating payment that is made at the beginning of each period such as a rent payment.

The payments in an ordinary annuity occur at the end of each period. Pure life is not in life contingency option. Systematic liquidation of an estate.

Click to see full answer. Multiple Choice C Series of cash inflows of varying amounts collected at the end of each period O Series of cash flows of equal amounts collected at the end of each period Series of. Period during which accumulated money is converted into income B.

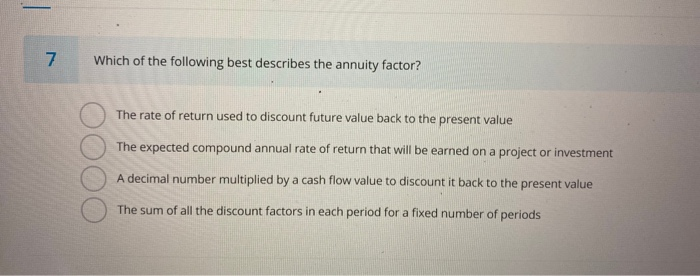

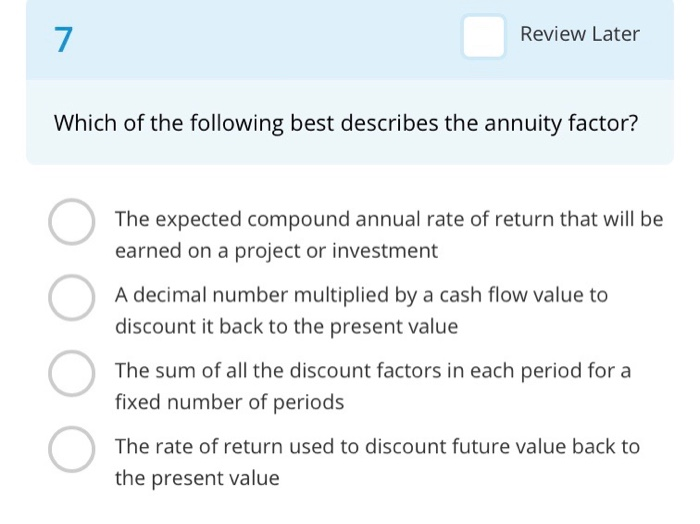

Which of the following is the best definition of an annuity. Period of time during which money is accumulated in an annuity D. Which of the following best describes an annuity.

Through annuitization your purchase payments what you contribute are converted into periodic payments that can last for life. An annuity is a long-term investment that is issued by an insurance company designed to help protect you from the risk of outliving your income. Which of the following best describes an annuity.

Payment at beginning of year. Asked Sep 24 2015 in Business by MangaLover. 18 hours agoAmericas vital interests in this war however are to prevent it from becoming a US-Russia war or a third world war or a nuclear war.

The correct answer is. Which of the following best describes a pure life annuity settlement option. O It can be used to predict the temperature of a certain material given its specific resistance.

Which of the following best describes what the annuity period is. 10-14 Which one of the following statements. It has the following characteristics.

Which of the following best describes the constant-growth dividend discount model. Fixed annuities pay the same amount in each period whereas the amounts can change in variable annuities. O It measures the final electrical resistance of a material per degree of temperature change.

C Growth is subject to immediate taxation D Taxes are deferred. Which of the following best describes the difference between an annuity due and an ordinary annuity. A series of payments to be received at a common interval during a period of time.

Annuities provide guaranteed income for life by systematically liquidating the sum of money that has accumulated in the annuity. Deposits are made at random whenever you have extra money into an account earning interest. OA lump sum is deposited into an account earning compound interest Deposits are made at random whenever you have extra money into an account earning interest.

The present value of a set of payments to be received during a future period of time. Which one of the following statements best describes an ordinary annuity. Life insurance can provide which of the following.

Which of the following best describes an annuity due. Lumpy cash flows at equal time intervals forever. All payments are in the same amount such as a series of payments of 500.

Equal cash flows at equal time intervals forever. Which of the following statements best describes an ordinary annuity. Payments at the end of the year is known as a regular annuity.

The term that best describes an annuity due is the payment at the beginning of the year. Americas interests are best served by an early and negotiated peace. Ad Learn More about How Annuities Work from Fidelity.

An ordinary annuity is a series of equal payments made at the end of each period for a. Period of time from effective date of contract to the date of its termination. Equal regular deposits are made into an account earning interest.

Solved Review Later If You Invest 2 000 With A 4 Interest Chegg Com

Solved 17 At The Age Of 68 Seth Elected A Life And 10 Year Chegg Com

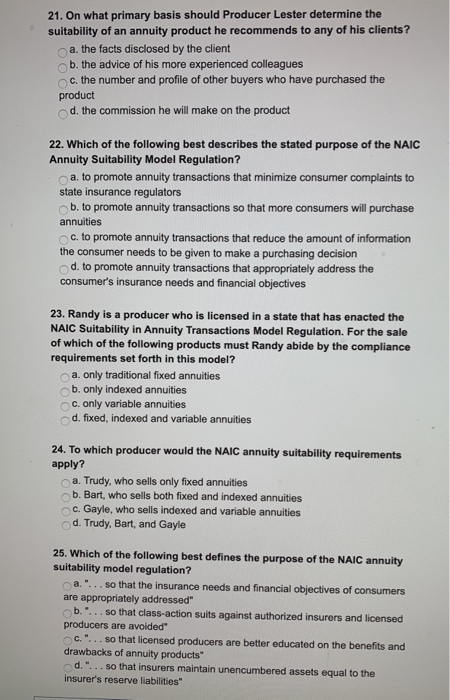

Solved Directions Choose The Best Answer To Each Question Chegg Com

No comments for "Of the Following Which Best Describes an Annuity"

Post a Comment